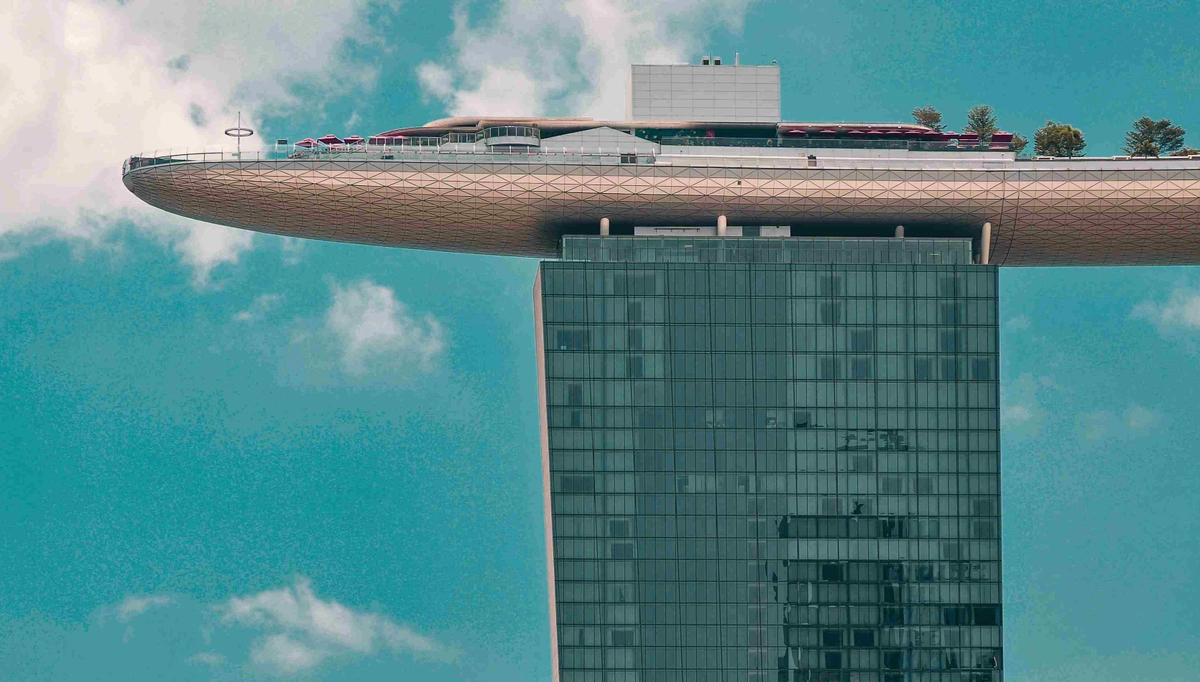

How Singaporean Corporate Bank Accounts Unlock Financial Efficiency

Singapore stands as a global financial hub, offering a myriad of banking solutions to businesses worldwide. The corporate bank account in Singapore is a cornerstone for businesses aiming to manage their finances efficiently, execute transactional banking services, and leverage global banking solutions. This blog will delve into the importance of ...