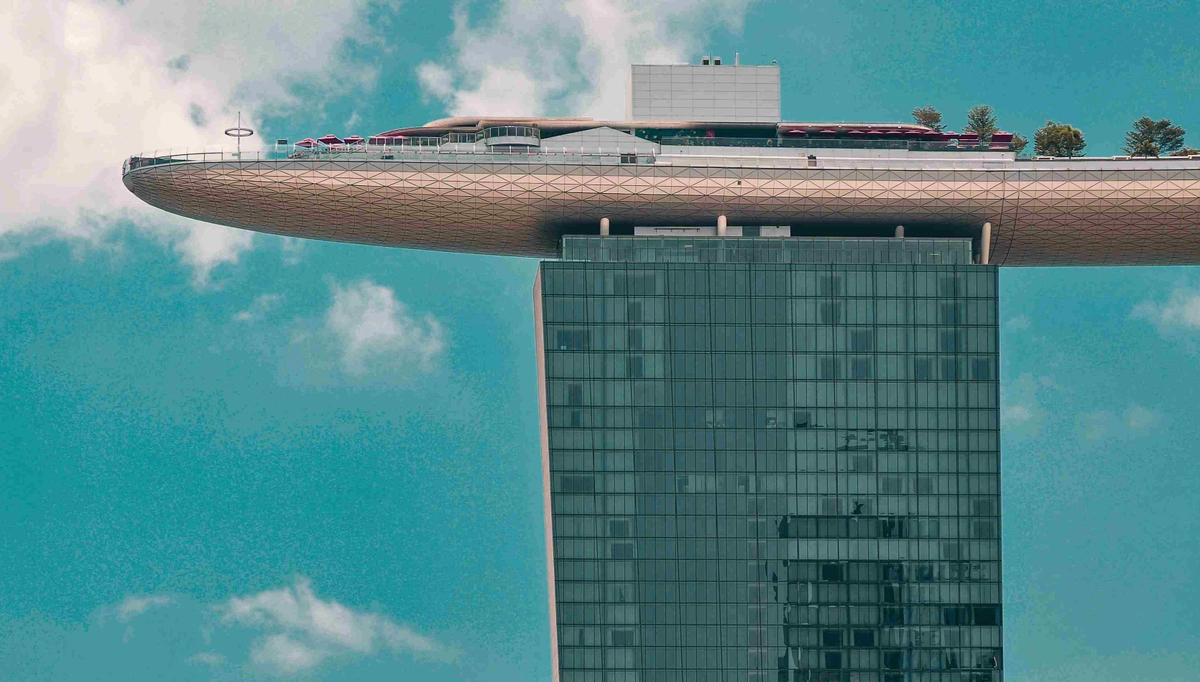

Innovative Global Banking Solutions for a Connected World in Singapore

Global banking has grown to be increasingly crucial in nowadays interconnected global, with businesses expanding across borders and requiring reliable and efficient banking solutions that transcend national boundaries. In Singapore, a leading financial hub in Asia, the banking sector has evolved to meet these demands through innovative approaches that cater ...